33+ payroll tax calculator louisiana

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Tax rate of 4 on taxable income between 12501 and 50000.

Academic Catalog By Bluefield College Issuu

Sign Up Today And Join The Team.

. The current wage base is 7700 and rates range from 009 to 620. Get honest pricing with Gusto. Web Each employer who withholds from the combined wages of all employees at least 500 but less than 5000 per month is required to pay on a monthly basis.

Total Estimated Tax Burden. Ad Fast Easy Affordable Payroll Services By ADP. The new W4 asks for a dollar amount.

It is not a. Ad Get full-service payroll automatic tax calculations and compliance help with Gusto. This free easy to use payroll calculator will calculate your take home pay.

Learn About ADP Payroll Pricing. Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Our income tax calculator calculates your federal. Web The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Louisiana residents only. CorpNet enables you to manage filings with ease.

Get Started with up to 6 Months Free. Web Louisiana Salary Paycheck Calculator. Web All employers file payroll tax reports quarterly using Form 941 Employers Quarterly Federal Tax Return.

Web Optional Select an alternate tax year by default the Louisiana Salary Calculator uses the 2023 tax year and associated Louisiana tax tables as published by the IRS and. Web For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in a given calendar year. Web Louisiana Income Tax Calculator 2022-2023 If you make 70000 a year living in Louisiana you will be taxed 10370.

Learn more about registering for payroll taxes without huge costs needless complexity. Ad Register for state payroll taxes today. 2023 ERC Program Eligibiliity Verification - Get Up to 26k Per Eligible Employee.

Web Fuel Tax. Web Pre-tax deductions result in lower take-home but also means less of your income is subject to tax. Heres how to calculate it.

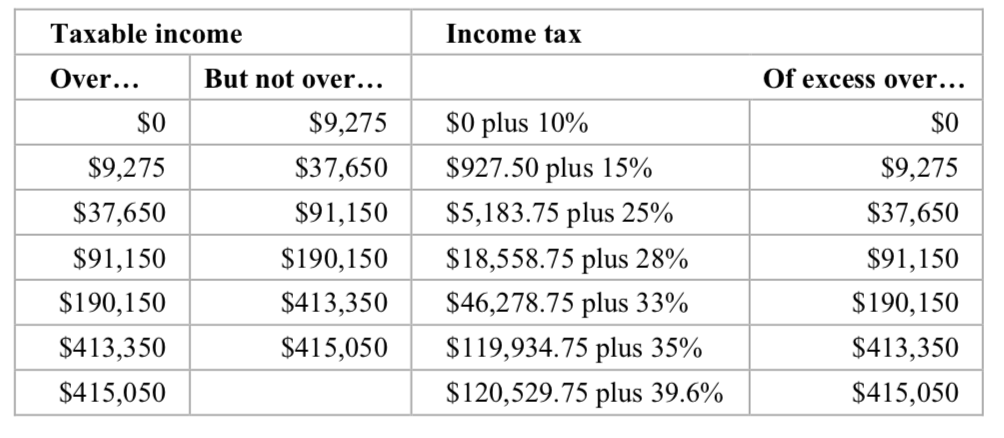

Calculate your Louisiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Web Louisiana Paycheck Calculator. Web calculate your taxable income Adjusted gross income Exemptions Taxable income understand your income tax liability Taxable income Income tax rate.

Employers also must match this tax. Free Unbiased Reviews Top Picks. With the use of the information obtained from Form R-1300 L-4 Employees Withholding.

Your average tax rate is 1167 and your marginal. Web The Louisiana Tax Calculator Estimate Your Federal and Louisiana Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married Filing. No more surprise fees from other payroll providers.

Some deductions are post-tax like Roth 401k and are deducted after being. Over 700000 Businesses Utilize Our Fast Easy Payroll. Ad Compare This Years Top 5 Free Payroll Software.

Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. All Services Backed by Tax Guarantee. Percent of income to taxes.

Get Your Quote Today with SurePayroll. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web All Louisiana businesses are subject to tax under the State Unemployment Tax Act SUTA.

Enter an amount for dependentsThe old W4 used to ask for the number of dependents. Tax rate of 6 on taxable income over 50000. Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds.

Web Payroll Tax Salary Paycheck Calculator Louisiana Paycheck Calculator Use ADPs Louisiana Paycheck Calculator to estimate net or take home pay for either hourly or. Select the set of tables that corresponds to the payroll period of the employee. Calculating your payroll and payroll taxes is essential to running a.

Ad Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. For married taxpayers living and working in the.

Supports hourly salary income and.

Louisiana Income Tax Calculator Smartasset

How Much Money Do You Make R Askanamerican

Pdf The Leader In Me An Analysis Of The Impact Of Student Leadership On Science Performance Matthew Ohlson Ph D Academia Edu

Structure Magazine May 2019 By Structuremag Issuu

How To Calculate Louisiana Income Tax Withholdings

U S Copyright Renewals 1967 January June By U S Copyright Office Pdf Project Gutenberg

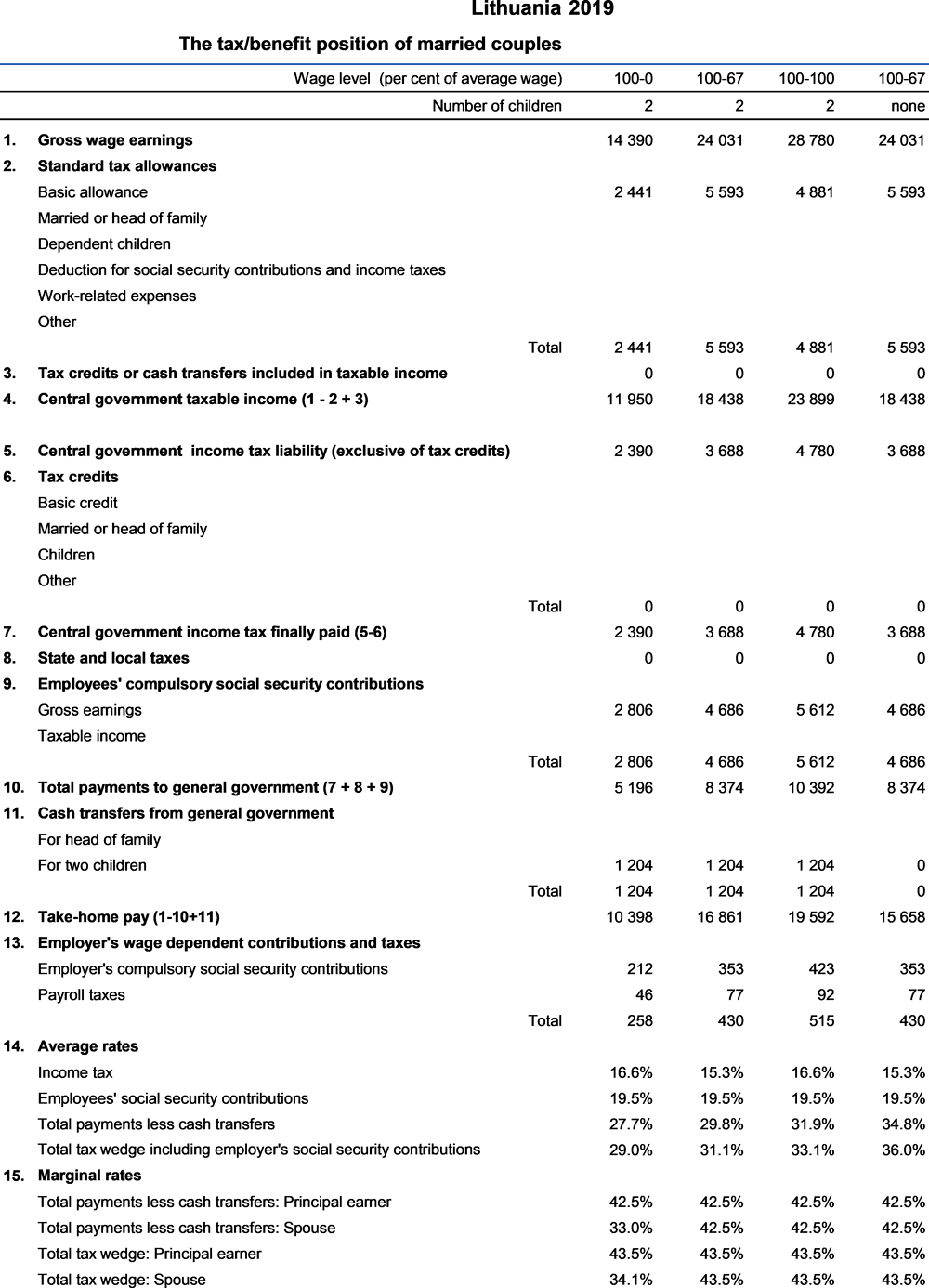

Lithuania Taxing Wages 2020 Oecd Ilibrary

50 Sample Payment Schedules In Pdf Ms Word

How To Reform Payroll Taxes To Fund Medicare For All People S Policy Project

Solved Extra 4 3 Develop The Income Tax Calculator In This Chegg Com

Louisiana Salary Calculator 2023 Icalculator

Tax Calculator Estimate Your Income Tax For 2022 Free

Louisiana Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator Louisiana 2023 La Hourly Salary

How To Calculate Payroll Taxes Wrapbook

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel